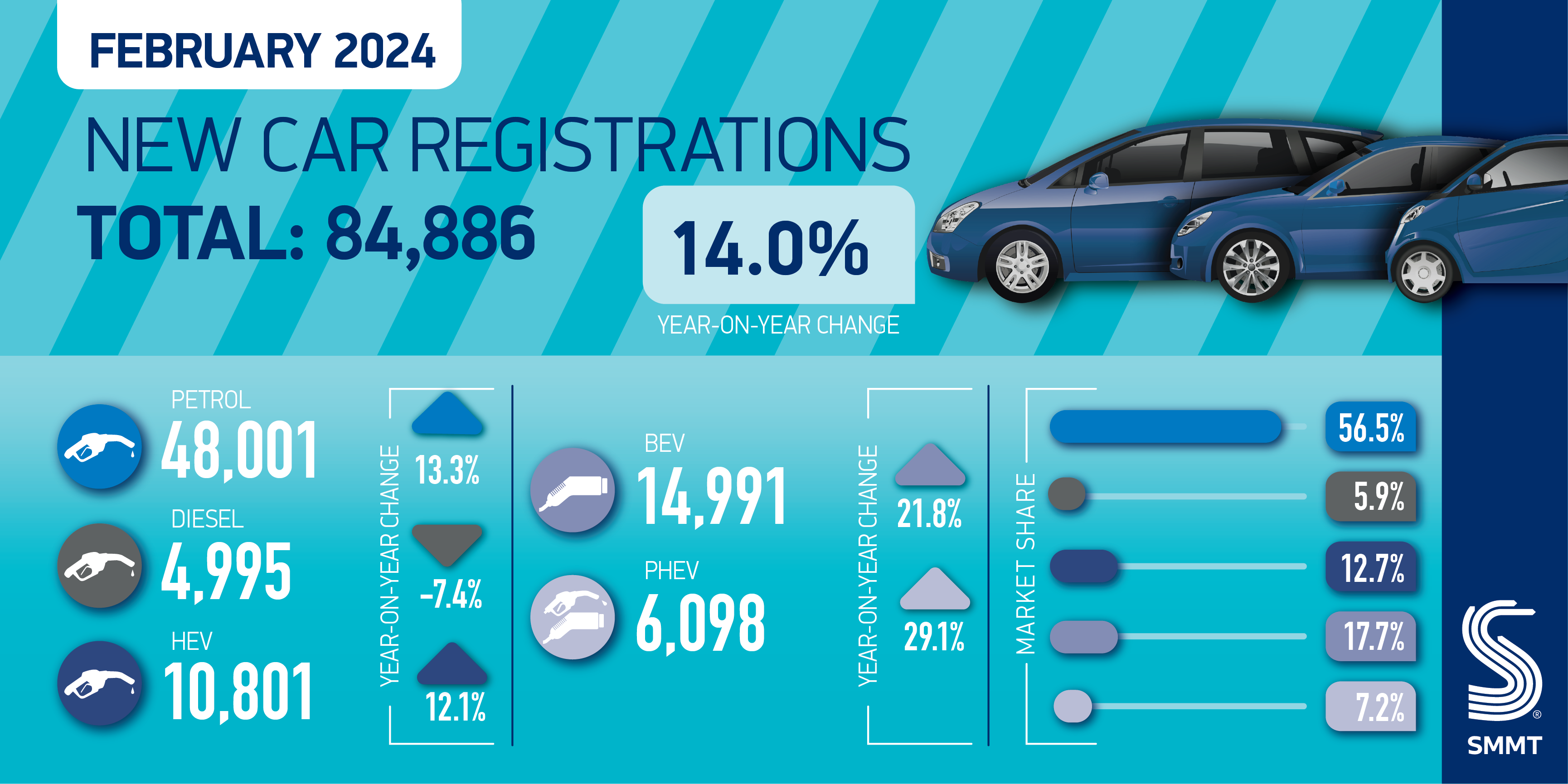

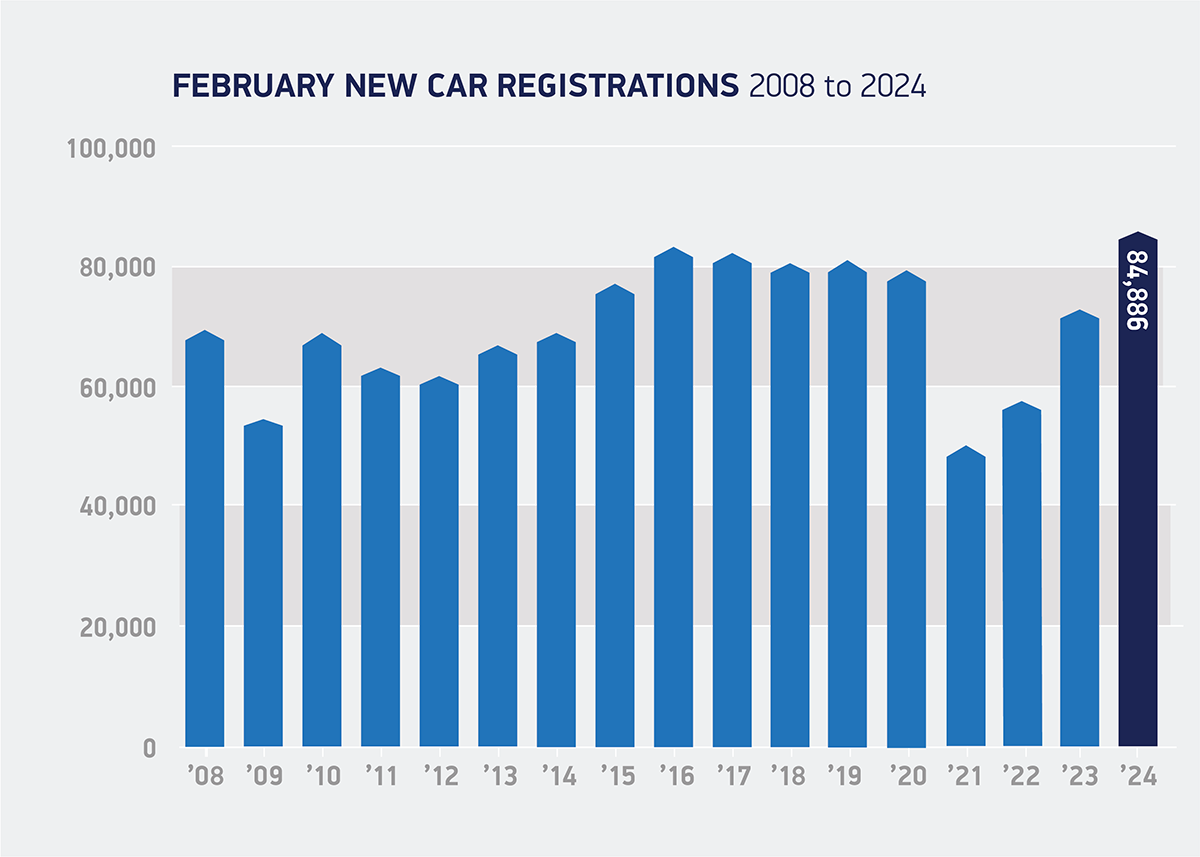

The UK new automobile market has recorded its finest February efficiency for twenty years as registrations rose 14.0% to 84,886 items, in keeping with the newest figures from the Society of Motor Producers and Merchants

The UK new automobile market has recorded its finest February efficiency for twenty years as registrations rose 14.0% to 84,886 items, in keeping with the newest figures from the Society of Motor Producers and Merchants.1

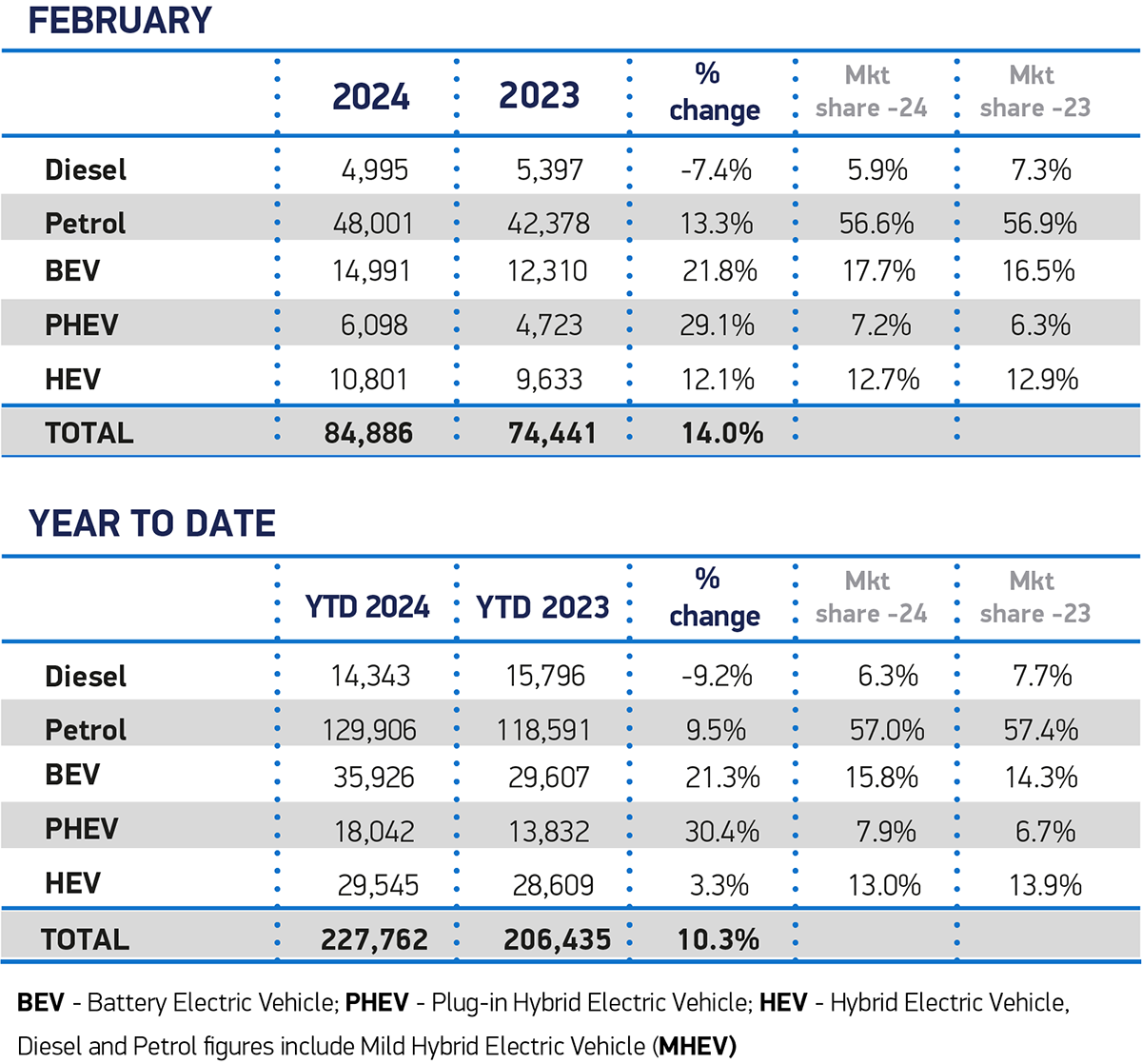

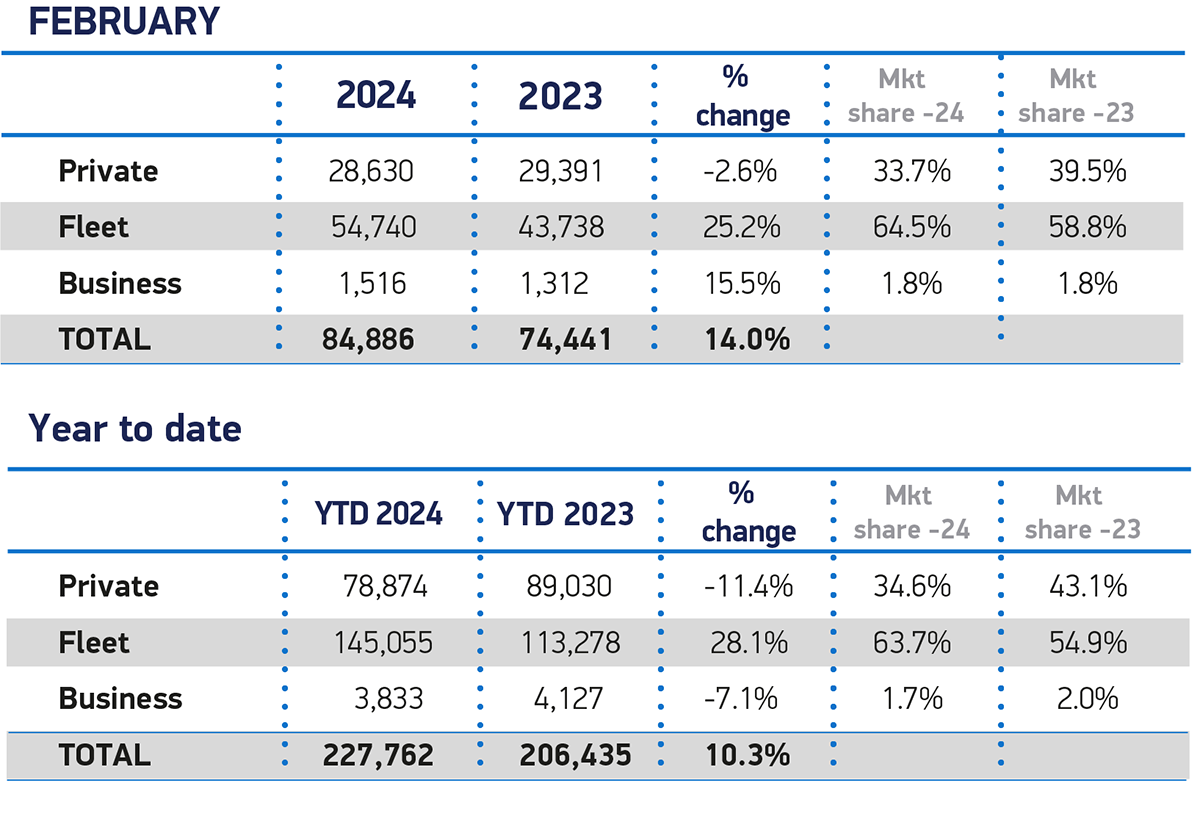

It was the nineteenth month of consecutive progress, which has primarily been pushed by fleets investing within the newest autos. Certainly, fleets and companies had been answerable for everything of February’s enhance, with registrations up 25.2% and 15.5% respectively. Non-public uptake continued to wrestle, with a -2.6% decline to document a 33.7% market share. February is historically unstable because the lowest quantity month of the 12 months, with patrons typically electing to attend till March and the brand new quantity plate.

Electrified autos recorded strong progress, with hybrid electrical autos (HEVs) rising 12.1%, however taking a touch smaller year-on-year market share of 12.7%. Plug-in hybrids (PHEVs) recorded the most important proportional progress for the month, rising 29.1% to succeed in 7.2% of the market. Battery electrical car uptake equally outpaced the remainder of the market, rising 21.8% to account for 17.7% of registrations, an enchancment on final 12 months’s 16.5%.

Whereas February’s progress is optimistic and demonstrative of ongoing strong demand for the newest autos, the long-term image will turn out to be clearer in March, the busiest market month. Whereas BEV market share and volumes proceed to develop in the course of the first 12 months of mandated targets for producers, the rise in uptake is solely sustained by fleets, thanks to forcing fiscal incentives. Non-public patrons account for fewer than one in 5 (18.2%) new BEVs registered in 2024 up to now.

A sooner, fairer market transition is determined by extra non-public patrons switching however the lack of serious incentives is holding again many. Tomorrow’s Finances is a chance for the Chancellor to stimulate demand by halving VAT on new EVs for 3 years, amending proposed Car Excise Obligation (VED) modifications, and lowering VAT on public charging according to dwelling charging.

Whereas customers don’t pay VAT on different emission discount applied sciences resembling warmth pumps and photo voltaic panels, non-public EV patrons pay the total 20% levied on all vehicles, whether or not they be electrical, petrol or diesel. Halving VAT on new EV purchases would save the typical purchaser round £4,000 off the upfront buy value – but price the Treasury lower than the Plug-in Automotive Grant that was scrapped in 2022.2

Equally, upcoming modifications to Car Excise Obligation subsequent 12 months would see nearly all of BEV patrons successfully penalised £1,950 for going electrical as a result of ‘costly automobile’ complement.3 Moreover, these unable to cost a BEV at dwelling at the moment pay a ‘pavement penalty’ of 20% VAT on public charging – quadruple the speed paid by these with the chance to cost at dwelling.

Mike Hawes, SMMT Chief Government, mentioned:

The brand new automobile market’s potential to ship progress continues with its finest February for 20 years and this week’s Finances is a chance to make sure that progress is greener. Tackling the triple tax barrier because the market embarks on its busiest month of the 12 months would increase EV demand, reducing carbon emissions and energising the financial system. It’ll ship a sooner and fairer zero emission transition, placing Britain’s EV ambition again within the quick lane.

1 February 2004 registrations: 91,460

2 Based mostly on SMMT evaluation and a mean JATO BEV buy value of £47,471 (1H 2023)

3 BEV exemption from Car Excise Obligation Costly Automotive Complement (utilized to autos with checklist value of or exceeding £40,000) ends in 1 April 2025. Complement price is at the moment £390pa on prime of ordinary VED price, payable from second to sixth 12 months inclusive after first car registration

SOURCE: SMMT