Nearly all of automobile patrons are glad with their expertise shopping for finance from sellers, in keeping with analysis by JudgeService.

The analysis was prompted by the Monetary Conduct Authority (FCA) probe into the usage of discretionary fee preparations earlier than they have been banned in January 2021 and the mis-selling marketing campaign launched final month by Cash Saving Professional, the buyer web site fronted by Martin Lewis.

Cash Saving Professional stated it has logged 1,080,000 automobile finance grievance letters which were submitted via its free automobile finance reclaim instrument since 6 February.

“That equates to a staggering 30,000 per day. A back-of-the-envelope calculation means this might be at the very least £480,000,000 again for these customers, or extra, as over 25% of complaints are from folks with a number of agreements,” it stated on its web site.

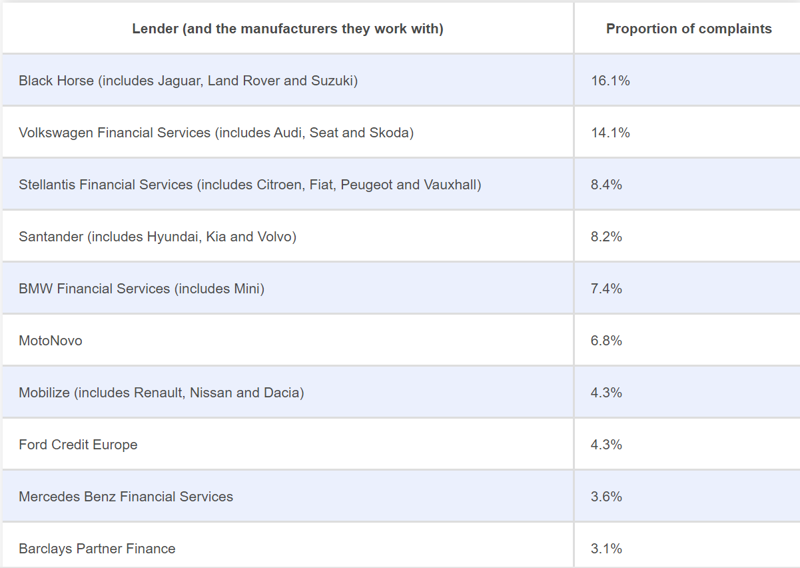

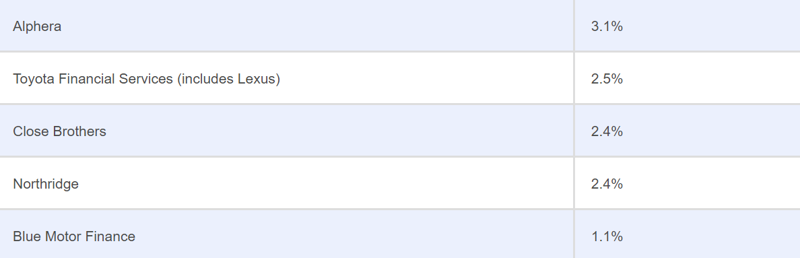

MSE added that probably the most complained about lenders to date included Black Horse, Volkswagen Monetary Providers and Stellantis Monetary Providers.

Knowledge from 212,986 questionnaires accomplished by clients in 2020 and 2023 sheds gentle nevertheless on how total satisfaction with vendor finance gross sales was excessive.

Final 12 months 93% of patrons surveyed by JudgeService stated they have been glad with the reason given to them by dealership gross sales workers of the accessible finance packages, up from 91% in 2020.

Whereas satisfaction with the reason of paperwork and documentation associated to finance elevated from 93.5% to 95%.

Patrons have been additionally requested to charge their satisfaction with the perspective of gross sales workers throughout the shopping for course of, this elevated from 95.8% to 97%.

“Regardless of the noise generated by the FCA probe and Cash Saving Professional’s compensation marketing campaign, our analysis reveals the excessive degree of buyer satisfaction associated to finance purchases each earlier than and after the ban on discretionary fee preparations,” stated Neil Addley, managing director of JudgeService.

“Our vendor purchasers often entry our finance satisfaction studies and obtain a notification if a buyer isn’t comfortable.

“What’s being neglected is that many automobile patrons are additionally savvy customers, they perceive that sellers earn fee on the finance they promote; they’re extra targeted on agreeing finance offers which are truthful and reasonably priced.

“Nevertheless, due to the ballyhoo round attainable mis-selling, many of those clients will now be trying to be compensated for one thing they have been glad with,” he stated.

Breakdown of greatest lenders complained to through MoneySavingExpert’s automobile finance instrument