Pinewood is poised to wrest market share from business rivals working within the UK’s £100 million dealership administration system (DMS) market since separating from Pendragon, in accordance with monetary providers group Zeus Capital.

Since finishing its transition right into a pure-play Software program as a Service (SaaS) entity, Zeus stated it noticed important potential in Pinewood’s North American three way partnership with Lithia – which has taken a 20% stake within the enterprise – which can assist drive the enterprise as a serious participant within the huge US automotive software program market.

Pinewood and Lithia, one of many largest motor retailers within the US, have every invested £10m within the three way partnership with perpetual rights to promote the Pinewood product within the North American market.

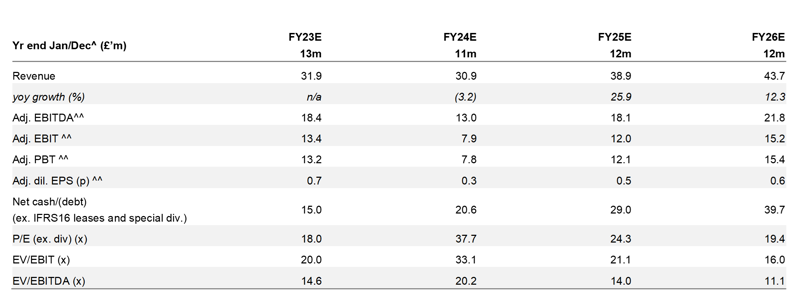

An accelerated development plan will see Pinewood aiming to develop from its present 33,000 DMS software program customers to 48,000 by 2027 with its cloud-based answer. Earnings are projected at £27m in that yr, representing 59% development versus an anticipated £17m for the 12 months to December 2023.

Whereas round 2,500 new customers will come from deploying the software program in Lithia’s 50 UK websites, Pinewood’s integration with 50 car OEMs and partnerships with producers ought to drive consumer quantity development internationally.

“For instance, rolling out the software program throughout all Porsche websites in Japan is anticipated so as to add round 4,000 customers and is already underway,” stated Zeus Capital in a brand new analysis paper.

Regardless of preliminary improvement which means Pinewood’s 49% stake’s might drop in worth, Zeus Capital’s stated its forecasts over the following two years reaffirmed its confidence and reiterated the case for funding.

“The potential for Pinewood to develop its consumer base each domestically and internationally, whereas sustaining sturdy EBITDA margins and money circulate conversion, seems promising.”

“Primarily based on the group’s focused FY27 EBITDA of £27m, we venture a reduced valuation of 23.7p per share, indicating a possible upside of 93%. Moreover, there exists additional development potential because the North American three way partnership solidifies its presence within the expansive US automotive software program market.”

Lithia’s community of roughly 17,500 customers throughout 300 US dealerships signifies that if the three way partnership captures a portion of Lithia’s annual spend of between US$100m-US$150m on DMS, CRM, and tech stack, it may probably generate earnings of US$60m within the medium time period.