Dynamics within the used market are set to rival the complexity of the pandemic period, in keeping with the newest Cox Automotive’s four-year market forecast.

It predicts {that a} dramatic decline in new diesel automobiles and a discount in petrol registrations may have a profound impression on the used market.

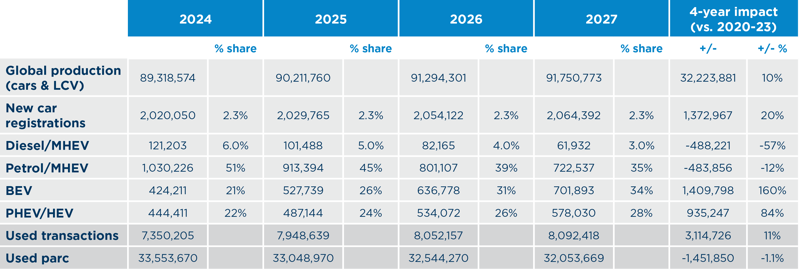

The forecast – which incorporates fuel-type breakdowns for the primary time – signifies that within the interval 2024-27, EV share of registrations will develop 160% vs 2020-23 volumes to 2.3 million items or 28% of gross sales.

Hybrid will signify 25% of registrations, with two million items bought. This development comes at a major value for diesel and petrol derivatives.

Diesel share over the 4 years will shrink to simply 3%, with 62,000 items registered in 2027, whereas petrol, with 3.5 million registrations over the 4 years, will fall 12% to only a 35% share by 2028.

Philip Nothard, perception director, Cox Automotive mentioned: “The registration of the millionth EV within the UK is a crucial milestone within the transition to zero-emission motoring. However with two in each 5 new automobiles becoming a member of the UK automobile parc this 12 months forecast to be EV or hybrid, and with that proportion destined to develop quickly in future years, dynamics within the used market over the subsequent 4 years will arguably rival the complexity and impression of these skilled throughout the pandemic.”

This alteration comes on the again of a brand new automobile market that contracted by nearly a 3rd within the 4 years between January 2020 and December 2023, when in comparison with the equal interval 2016-19, a lack of 3.1 million automobiles.

The composition of the UK automobile parc has additionally modified. In 2016, EV claimed simply 0.4% share and hybrid took 3%. By 2019, this had risen to 1.6% and 6%, respectively, and by the top of 2023, their share had every shot as much as 17% and 20%.

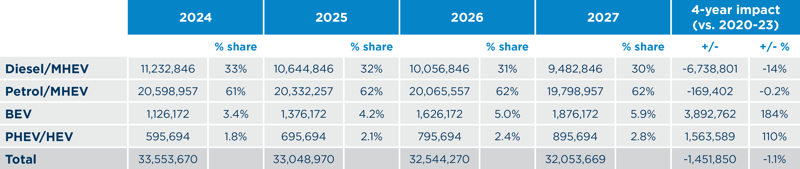

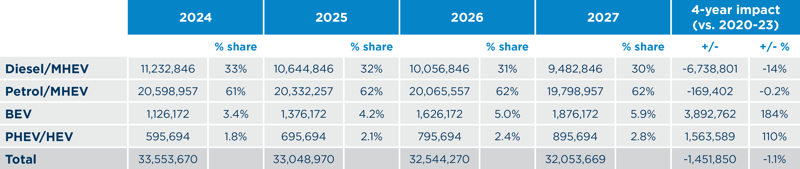

The other could be mentioned for petrol and diesel. Within the interval 2016-19, ICE automobiles made up 95% of latest automobile registrations. That quantity fell to 71% within the interval 2020-23, a lack of 4.6 million automobiles. The ICE decline accelerated all through this era, dropping from an 83% market share in 2020 to 64% in 2023.

Cox Automotive forecasts an additional drop of 35% between now and the top of 2027, which means simply 784,000 new ICE autos will hit the highway in 2027 versus the 1.2 million recorded in 2023.

Diesel has skilled essentially the most dramatic decline, from a 38% share in 2016-19, to 13% in 2020-23. By 2023, diesel autos – together with mild-hybrid variants – represented simply 8% of latest registrations. Cox Automotive predicts that this share may have declined to three% by 2028, a lack of an additional 488,000 autos over 4 years, along with the two.9 million misplaced since 2020.

At 57% in 2016- 19 vs 58% in 2020-23, petrol volumes have remained regular. Nonetheless, Cox Automotive foresees a decline over the subsequent four-years, with its share of all registrations dropping to 51% by the top of this 12 months and 35% by 2028. This equates to a lack of 2.3 million petrol-powered autos aged 0-8 years from the used market by the top of 2027.

Nothard mentioned: “It’s nearly unattainable to overstate the shift within the UK automobile parc over the previous 4 years and the way that change will proceed to speed up. As we speak’s parc for automobiles aged 0-4 years differs considerably from 2020 and can distinction much more so in 2028.

“Producers will proceed to be pushed by laws reasonably than shopper demand and ICE will likely be all however gone from the UK new automobile market lengthy earlier than the 2035 deadline. For used automobile retailers, this implies a battle for the most effective inventory, for shoppers it means diminishing selection and above-inflation worth will increase.”

Cox Automotive cautioned as as to if shopper demand for used EVs will replicate the tempo of EV registrations within the medium time period. Nothard mentioned he believes we are going to expertise an growing oversupply of EVs into the used market, at the least till values grow to be much less unstable and shopper confidence grows, and worth parity between EV and ICE is as more likely to be pushed by ICE values rising as by EV costs dropping.

“We should do not forget that in 2023,” he mentioned, “94% of used automobiles bought had been ICE and plenty of shoppers will doubtless stay loyal to this gas sort for so long as they will. The typical used automobile purchaser is usually in search of to exchange their current automobile with one thing comparable that’s inexpensive and suits their way of life. They might not but be able to make the leap into EV for monetary, infrastructure or use-case causes.

“And whereas the marketplace for used EVs will now set up itself as volumes come on stream, it faces competitors from producers and sellers chasing new registration quantity through compelling offers and finance affords. Many potential used consumers are cautious about longer-term EV values, their comparably excessive outright buy value and the danger of technological obsolescence.

“That isn’t to say EVs don’t signify good worth on the used market or will sit on forecourts unsold – actually, there’s proof that reveals the opposite is occurring. Nevertheless, there may be additionally loads of proof pointing to reticence on the a part of non-public consumers whereas volumes within the used market are at the moment too small to attract significant conclusions.”

Nothard concluded: “That is under no circumstances an image of doom for the used automobile sector, however it might be naive to assume the so-called new regular has but been established. The general used market is forecast to rise modestly, albeit its composition by 2028 will differ from what we’re used to right now.”