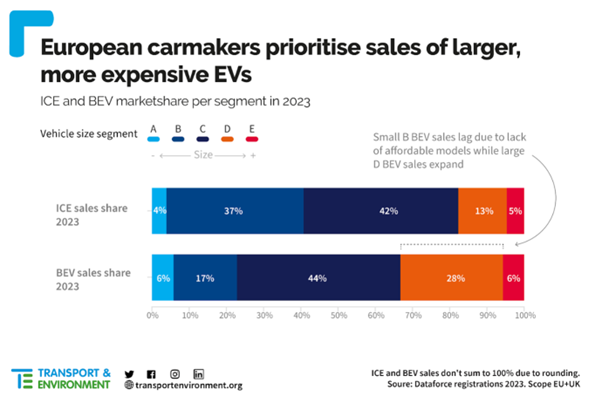

Solely 17% of electrical automobiles offered in Europe fall into the inexpensive compact B section, in comparison with 37% of latest combustion engine autos, in accordance with new evaluation from Transport and Setting (T&E).

This disparity means that carmakers are hindering electrical automobile (EV) adoption by prioritising the sale of bigger, costlier electrical fashions.

Between 2018 and 2023, the report reveals that solely 40 absolutely electrical fashions have been launched within the compact segments (A and B), whereas 66 giant and luxurious fashions (D and E) have been launched.

In Europe, 28% of electrical automobile gross sales are within the giant automobile D section, far increased than the 13% of latest combustion automobile gross sales, as per T&E’s evaluation of 2023 gross sales figures from Dataforce.

Moreover, T&E notes a major improve within the common worth of battery electrical automobiles in Europe by 39% (£15,000) since 2015, contrasting with a 53% decline in China.

Anna Krajinska, T&E’s automobile emissions supervisor, is important of European carmakers for not introducing inexpensive EV fashions rapidly and at scale, which she believes is limiting mass-market adoption.

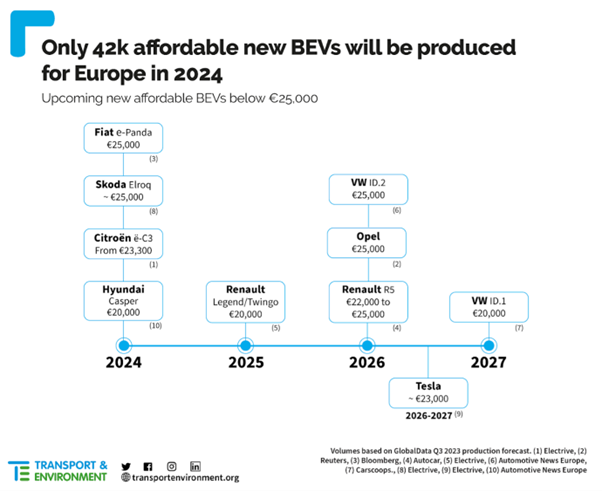

T&E claims that of the sub-€25,000 (£21k) fashions deliberate by carmakers, solely 42,000 autos are anticipated to be produced for the European market within the present yr.

This contrasts with China, the place 75 BEV fashions can be found for lower than €20,000. Krajinska highlighted the disparity in pricing, with common costs in Europe remaining excessive even within the compact segments: €34,000 (A), €37,200 (B), and €48,200 (C).

Furthermore, the main focus of European carmakers on SUVs, accounting for 54% of BEV fashions launched since 2018, has additional impacted affordability as SUVs command a major worth premium in comparison with non-SUV fashions within the compact B (+€6,100) and C (+€12,100) segments.

Whereas some European carmakers have introduced plans to introduce cheaper compact fashions between 2024 and 2027, such because the Renault 5 and VW ID.2, the projected manufacturing quantity for 2024 in Europe is lower than 50,000 items, unlikely to fulfill demand and might go away the European compact mass market weak to Chinese language competitors.

Krajinska warned that many Chinese language manufacturers are getting into or planning to enter the European market with electrical fashions, usually at extra inexpensive costs and doubtlessly aggressive methods of Chinese language opponents.

“Chinese language carmakers might doubtlessly even promote some fashions at a loss to achieve model recognition and market share. Even when rules stagnate, incentives are rolled again and the financial local weather isn’t preferrred, European carmakers are mistaken in the event that they consider slowing down now will assist their competitiveness or survival.”