Shopper demand, velocity of sale and transactions within the used automotive market all rallied in February, in response to the most recent information from Auto Dealer.

Regardless of such beneficial market situations and strong underlying market well being, common retail costs have been down -8.3% year-on-year (YoY), marking the sixth consecutive month of decline.

There are indicators, nevertheless, of retail costs stabilising, with February recording the bottom price of month-on-month (MoM) contraction (-0.6%) since October 2023.

Demonstrating the energy of the used automotive market, Auto Dealer recorded circa 81.7 million cross platform visits to its market in February, which is a 9.4% improve on the identical interval final 12 months.

This elevated engagement on web site is being fuelled by the strong ranges of client demand; Auto Dealer’s information reveals that demand was up 8% YoY in February, which is an uptick on the 6% recorded in January.

Reassuringly, Auto Dealer’s client analysis factors to sustained demand, with circa 80% of in-market automotive patrons surveyed claiming to be as assured of their capability to afford their subsequent automotive as they have been final 12 months; almost a 3rd (31%) mentioned they have been ‘way more’ assured.

Present demand is additional highlighted by the present velocity at which used vehicles are promoting. Actually, it took a median of simply 27 days for a used automotive to promote in February, the quickest velocity of sale in 12 months, and a major acceleration on the 40 days recorded in January.

Highlighting the nuances of the retail market, vehicles offered even sooner inside sure segments; for instance, the common 3-5-year-old automotive took simply 26 days to promote, and quantity manufacturers took simply 25. On account of this sturdy demand, Auto Dealer information has reported an identical uptick in transactions, with its retail gross sales tracker recording a YoY development of round 3% in February.

In addition to client demand, February noticed a rise within the degree of provide coming into the used automotive market with the speed of development rising 2.8% on the identical interval final 12 months. It marks the most important 12 months on 12 months provide development since October 2022 and is being fuelled by the 15.5% improve in vehicles aged over 5-years-old. Potential general development, nevertheless, is hampered by the continuing squeeze on provide of 1-5-year-old inventory (-13.7% YoY) because the circa 3 million ‘missed’ gross sales in the course of the pandemic continues to stream by means of the market.

Regardless of the general improve in February, provide development stays effectively beneath development in client demand, and in consequence, Auto Dealer’s Market Well being metric, which assesses potential market profitability, rose 5.1% YoY in February, up from the 4.2% recorded in January.

While Market Well being was largely up throughout all market segments, as with velocity of sale, there’s vital nuance, influenced by variances in provide and demand dynamics. For instance, exceptionally sturdy demand for vehicles aged beneath 12 months, up circa 32% YoY, is sort of equally matched by a 30% uplift in provide, and in consequence Market Well being elevated simply 1.4%.

These aged 1-3, nevertheless, noticed demand improve 15.8% YoY, far outpacing the -15.3% drop in provide, and as such, Market Well being elevated a assured 37%. Demand for used petrol vehicles (6.2%) was solely simply forward of provide (5.6%), leading to a conservative 0.6% improve in Market Well being. However in distinction, demand for used electrical automobiles surged a large 81.5% YoY in February, which mixed with a -1.1% fall in provide, drove a whopping 83.6% improve in Market Well being.

Regardless of these beneficial market situations, Auto Dealer is seeing under-pricing of excessive demand inventory, which is probably going in response to tendencies in wholesale values, which stay down circa -13.4% YoY. Auto Dealer information reveals circa 41,000 vehicles with a excessive Retail Ranking rating presently being marketed beneath their market common from the primary day of being listed. This behaviour – basing costs on commerce relatively than retail – shouldn’t be solely unduly pulling common costs down, but additionally eroding retailers’ margins, doubtlessly costing round £27m.

Commenting, Richard Walker, Auto Dealer’s information & perception director, mentioned: “February was one other constructive month for the used automotive market – demand was sturdy, inventory offered shortly, and extra vehicles have been offered than final 12 months. It’s disappointing subsequently that retail costs have been beneath the place we’d count on them to be given the in any other case very strong market well being.

“Wholesale values are enhancing, and the variety of automobiles being underpriced is falling, however nonetheless too many retailers are being guided by commerce relatively than retail, and the result’s an pointless erosion of margin. To maximise the complete potential presently out there available in the market, I’d strongly urge retailers to utilise our valuations information, which relies on the most important single view of the retail market and out there to all our companions.”

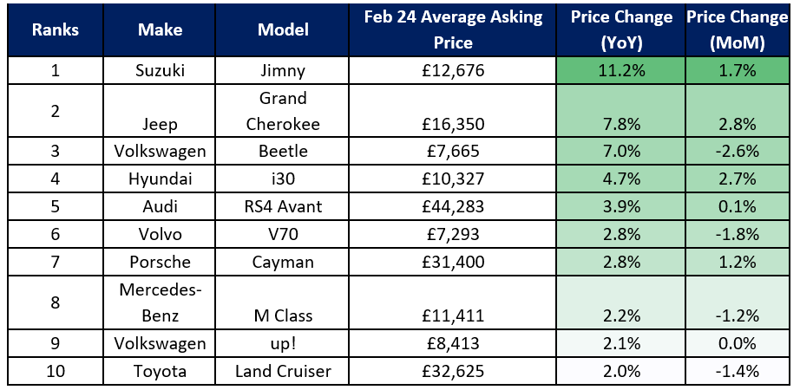

High 10 used automotive value development (all gas varieties) | February 2024 vs February 2023 like-for-like

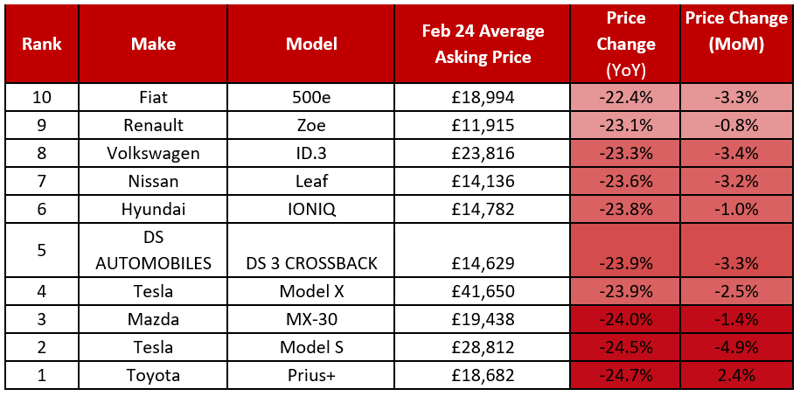

High 10 used automotive value contraction (all gas varieties) | February 2024 vs February 2023 like-for-like