Common automobile costs proceed to be pulled down by underpricing of exceptionally excessive demand inventory, fuelled by latest developments in wholesale values, in line with Auto Dealer’s Retail Value Index which reveals a drop of -7.5% year-on-year (YoY) and like-for-like in January.

The used automobile market nonetheless noticed a assured begin to the brand new 12 months, with each transactions and shopper demand recording progress in January,

Ranges of shopper demand on Auto Dealer remained buoyant in January, rising 6.1% YoY, and nicely forward of provide, which recorded a progress of simply 1.2%. Because of this, Auto Dealer’s Market Well being metric, which assesses potential market profitability based mostly on provide and demand dynamics, rose to a wholesome 4.8% on January 2023.

Sturdy shopper urge for food was additionally evident within the document site visitors to Auto Dealer’s market, which final month noticed a complete of over 85.5 million cross platform visits; an enormous 27.5% enhance on December, and 6.4% on the 80.4 million recorded in January 2023 – a document on the time.

This demand was translated into transactions, with early indications from Auto Dealer’s retail gross sales information suggesting a 1.6% enhance in used automobile gross sales in comparison with final 12 months.

Regardless of such sturdy market fundamentals, nonetheless, a proportion of high-demand inventory remains to be being under-priced on Auto Dealer, though reassuringly, at a slowing charge from latest highs. At the moment, circa 46,000 vehicles with a excessive Retail Score rating – a novel, machine studying derived measure of how briskly a automobile is more likely to promote if priced at its market worth – of over 61 have been marketed under their market common from the primary day of being listed. Because of this, a possible revenue of round £30m is being missed.

Trying on the information at a extra granular degree reveals that a lot of even probably the most in-demand autos available in the market are being priced under their retail worth. The truth is, 3,400 retailers are selecting to record circa 9,300 of the ‘best-of-the-best’ vehicles – with a Retail Score above 81 – on Auto Dealer under 95% of their respective market common. It represents a possible revenue alternative for retailers of circa £8m.

Nuanced retail market

Highlighting the nuance within the retail market, the typical worth of sub three-year-old (£28,031) vehicles are down -9.7% YoY (hampered by the continued de-fleeting of the circa 750,000 electrical autos offered during the last three years), while these aged 3-5-years (£19,114) and 5-10-years (£13,352) noticed a decline of -9.2% and -4.8% respectively. Used vehicles aged over 10-years-old, nonetheless, are nonetheless recording optimistic worth progress, with 10–15-year-old autos up 3.7% YoY to £6,457.

gasoline kind, costs for electrical autos are down -21.8% YoY (£28,836), while petrol (£15,256) and diesel (£15,111) are down -6.2% and -5.8% respectively. That is regardless of very beneficial market dynamics; throughout all gasoline sorts, ranges of demand progress is outpacing provide, which beneath regular situations would preserve worth stability. That is particularly evident in electrical autos, the place demand progress has elevated a large 65%, while ranges of provide, is down -2.4%, leading to Auto Dealer’s Market Well being metric rising a whopping 69%.

Commenting, Richard Walker, Auto Dealer’s information & perception director, mentioned: “In addition to our personal metrics, it’s reassuring to see broader financial indicators pointing to steady and sturdy market situations, together with the newest shopper confidence information, which reached a two-year excessive in January. Though fewer than we’ve seen beforehand, given such optimistic market fundamentals, it’s disappointing to nonetheless see inventory being priced beneath their true market worth, significantly what we’d name the best-of-the-best. By not making use of a retail-back strategy to pricing, retailers are liable to promoting themselves quick and lacking out on important revenue alternatives.”

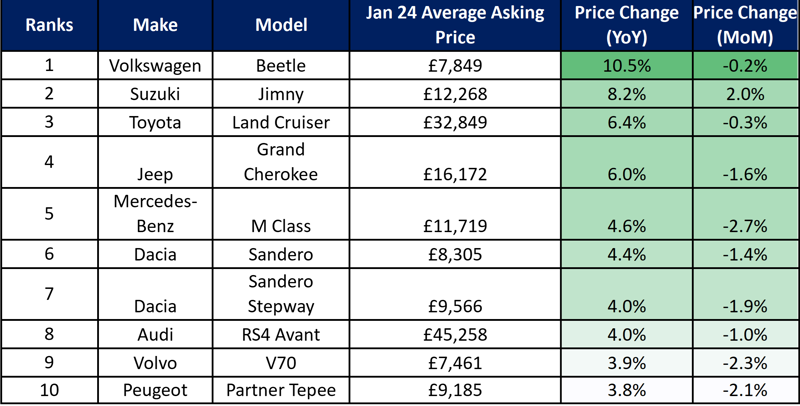

High 10 used automobile worth progress (all gasoline sorts) | January 2024 vs January 2023 like-for-like

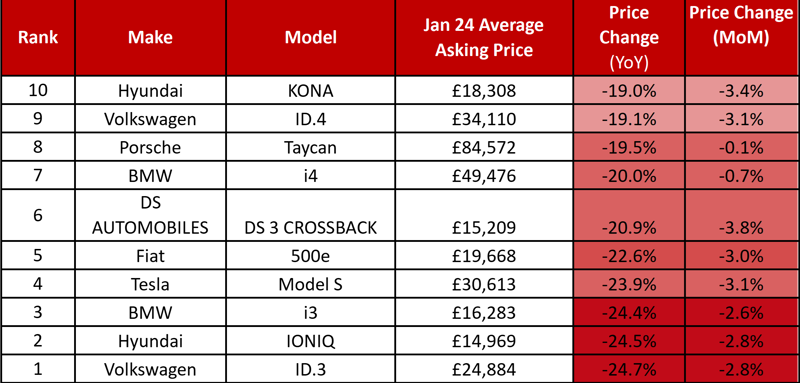

High 10 used automobile worth contraction (all gasoline sorts) | January 2024 vs January 2023 like-for-like