March noticed heartening indicators of retail costs of used automobiles persevering with to stabilise as actions adopted extra ordinary seasonal patterns.

In line with the Auto Dealer Retail Worth Index, which is predicated on 800,000 each day pricing observations, and the information for which has now been totally integrated into the Workplace for Nationwide Statistics’ inflationary measures, common costs softened simply -0.7% month-on-month (MoM) in March, which is in step with pre-COVID norms for this time of yr.

It mentioned the used automotive market entered the second quarter with vital momentum, with each pace of sale and ranges of shopper engagement on its market platform, reaching report ranges in March.

As such retail costs are stabilising largely resulting from beneficial market dynamics. Auto Dealer’s onsite information reveals that total shopper demand rose 6% YoY final month, outpacing present ranges of provide progress, which have been up simply 0.7% – the bottom stage of provide progress since July 2023.

The sturdy ranges of demand available in the market is mirrored within the report 89.1 million cross platform visits to Auto Dealer in March. It marks an 8% year-on-year (YoY) improve, and a 9% rise on February’s in any other case very sturdy efficiency (81.7m). Throughout the quarter, Auto Dealer acquired over 256.4m visits to its market, up 18.7m on Q1 2023.

Used automobiles additionally took a median of simply 25 days to go away retailers’ forecourts final month, which was two days sooner than February and three days sooner than March final yr. It additionally marks the quickest month-to-month tempo ever recorded by Auto Dealer.

Importantly, it mentioned, this demand is translating into transactions. Though down round 1% on March 2023, partly resulting from some retailers being caught out with difficulties sourcing substitute inventory for automobiles offered faster than anticipated, Auto Dealer’s retail gross sales information signifies a optimistic 2% YoY improve throughout the quarter.

The outlook for the used automotive market stays steady, however with such nuance available in the market, it’s vital to look at the information at a granular stage to not solely establish rising revenue alternatives, but in addition potential developments which will have an effect on backside traces. Certainly, while there are variances in provide and demand throughout completely different segments of the market, there are particular key cohorts the place the dynamics are enjoying out extra dramatically and can should be monitored fastidiously.

For instance, ‘almost new’ automobiles (these aged beneath 12 months previous) are at present recording exceptionally excessive ranges of each shopper demand and provide, up 30.4% YoY and 42% respectively final month. Nonetheless, with producers making use of heavy reductions to brand-new automobiles to stimulate retail demand, notably for the rising array of electrical fashions, almost new fashions are set to face growing competitors this yr. Consequently, demand might nicely soften while provide ranges proceed to soar as producers as soon as once more resort to quick cycle gross sales channels to realize quantity targets.

Amongst older cohorts, inventory aged 10-15-years-old might face an identical impression on market dynamics over the approaching months. While sturdy provide (up 12.1% YoY in March) is already outpacing a current softening in shopper demand (down -3.3% YoY) on Auto Dealer, the imbalance is barely set to extend as the massive variety of brand-new automobiles offered throughout the 2014 – 2016 increase stream by way of the used automotive market. So, while demand seems set to stay comparatively steady for these extra inexpensive automobiles, provide ranges might quickly start to speed up additional.

Commenting, Richard Walker, Auto Dealer’s information & insights director, mentioned: “Regardless of an unsure financial and political backdrop, we’ve seen a optimistic begin to 2024, with demand remaining sturdy all through the quarter. However while our outlook for the remainder of the yr is assured, retailers face an extremely nuanced and complicated market which is able to proceed to maneuver at tempo.

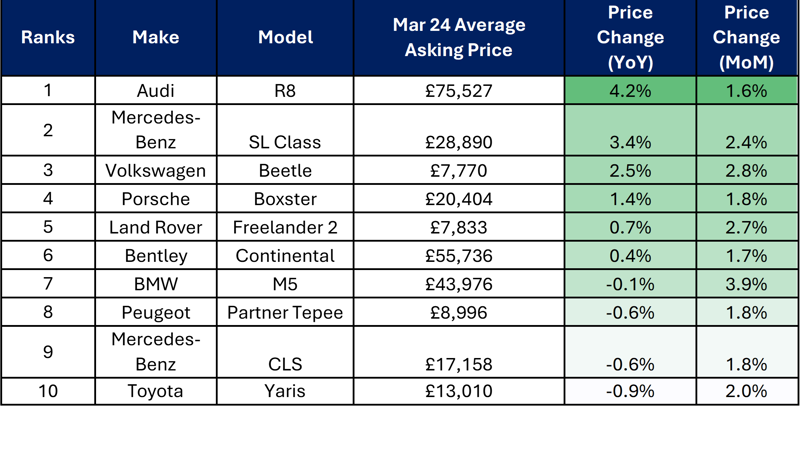

High 10 used automotive value progress (all gasoline varieties) | March 2024 vs March 2023 like-for-like

High 10 used automotive value contraction (all gasoline varieties) | March 2024 vs March 2023 like-for-like